Tesla shares slid again Monday even as the broader market continued to pull itself out of correction territory, as shares of the electric vehicle maker led by the world’s richest man, Elon Musk, faced further pressure from Wall Street as Musk grows embedded in the White House.

KEY FACTS

Shares of Tesla declined nearly 5% to $238 per share Monday, a sour start to the week for Tesla after it ended Friday trading at its lowest end-of-week level since the week before the election. Tesla’s loss moved against a broader recovery, as the S&P 500 gained 0.7%, building on Friday’s 2.1% rebound and heading to its highest close in 10 days.

Tesla was Monday’s worst-performing stock of any of the roughly 100 S&P constituents valued at $100 billion or above, according to FactSet data. The drop came as Musk’s firm faced yet another ding from Wall Street analysts.

In a Sunday note to clients, Mizuho analysts led by Vijay Rakesh lowered their price target for Tesla shares by $85 to a still bullish $430 and lowered their 2025 vehicle delivery forecast from 2.3 million to 1.8 million, a more than 20% cut that falls well below consensus forecasts of 2 million deliveries.

Rakesh chalked up Tesla’s sales woes to weakening “brand perception” in the U.S. and the European Union, a “deterioration in geopolitics” and increasingly challenging competition in China from domestic EV firms.

Mizuho analysts said Tesla’s U.S. sales last month declined 2% year-over-year as the broader EV market rose by 16%, its China sales cratered 49% as EV sales in the country grew by 85% and its Germany sales tanked 76% as the European nation’s EV market expanded by 31%.

KEY BACKGROUND

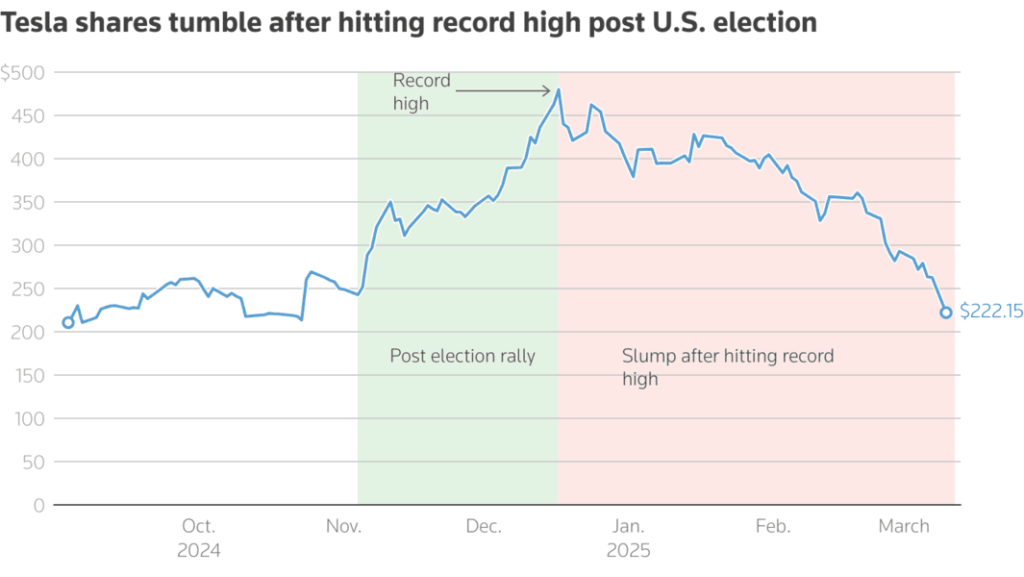

Shares of Tesla are down 41% year-to-date, the second-worst loss of any company listed on the S&P. Mizuho joined the likes of Goldman Sachs, JPMorgan and UBS in slashing its delivery forecasts for Tesla. “We struggle to think of anything analogous in the history of the automotive industry, in which a brand has lost so much value so quickly,” Last week, JPMorgan analysts described the recent melting of Tesla’s perception, especially in pockets of the world in which Musk inserted himself into right-wing politics, such as Germany. Though Musk is perhaps the closest ally of President Donald Trump, the latter’s hawkish tariffs are a major drag on Musk’s main source of wealth, Tesla.

In a letter to the Office of the United States Trade Representative submitted last Tuesday, Tesla lobbied the Trump administration to take a “phased approach” on tariffs and consider Tesla’s EVs contain “certain parts and components” which “are difficult or impossible to source within the United States,” a break from Trump’s frequently shifting tariff deadlines and targets. About 53% respondents to a CNN poll published last week said they hold a negative opinion of Musk compared to roughly 35% with a positive view and about 11% with no take.

CONTRA

Tesla stock is still up 7% from last Monday, when it suffered a 4.5-year-worst 15% amid a broader selloff tied to economic uncertainty fears linked to Trump’s tariffs.

FORBES VALUATION

Musk’s $329 billion net worth makes him easily the richest person on the planet, though that’s down more than $130 billion from its peak of $464 billion set in December when Tesla stock traded at about $480 following a post-election upward swing.

ADDITIONAL INSIGHTS

March 12 (Reuters) – JP Morgan cut its price target on Tesla’s stock as the brokerage expects a second straight year of lower deliveries, with analysts also pointing to a change in sentiment toward the EV maker from existing customers and potential new buyers. There have been reactions toward the brand such as protests at Tesla stores across the U.S. and around the world, sales boycotts, and jettisoning already purchased vehicles in the second-hand market, the brokerage said.

J.P Morgan also cut its price target on the electric-vehicle maker’s shares to $120 from $135. The median target for the stock is $370, according to LSEG data. The brokerage said it expects Tesla to deliver about 1.78 million vehicles this year, down about 1% from 2024.

Recently, activists have staged so-called “Tesla Takedown” protests to express their displeasure at Elon Musk’s involvement in significant reductions to the U.S. federal workforce and the cancellation of contracts funding global humanitarian efforts. Musk, currently the world’s wealthiest person, is leading the Trump administration’s Department of Government Efficiency.

In a show of support for the EV maker’s CEO Musk, U.S. President Donald Trump said on Tuesday that violence against Tesla dealerships will be labeled domestic terrorism. Tesla’s shares have slumped after hitting an all-time high in December, erasing most of the gains the stock made after Trump won the U.S. election in November. The stock has gained 10% since Monday’s 15.4% slump, its worst one-day drop in four-and-a-half years.

For More Check Out Our Latest News Updates Click Here!